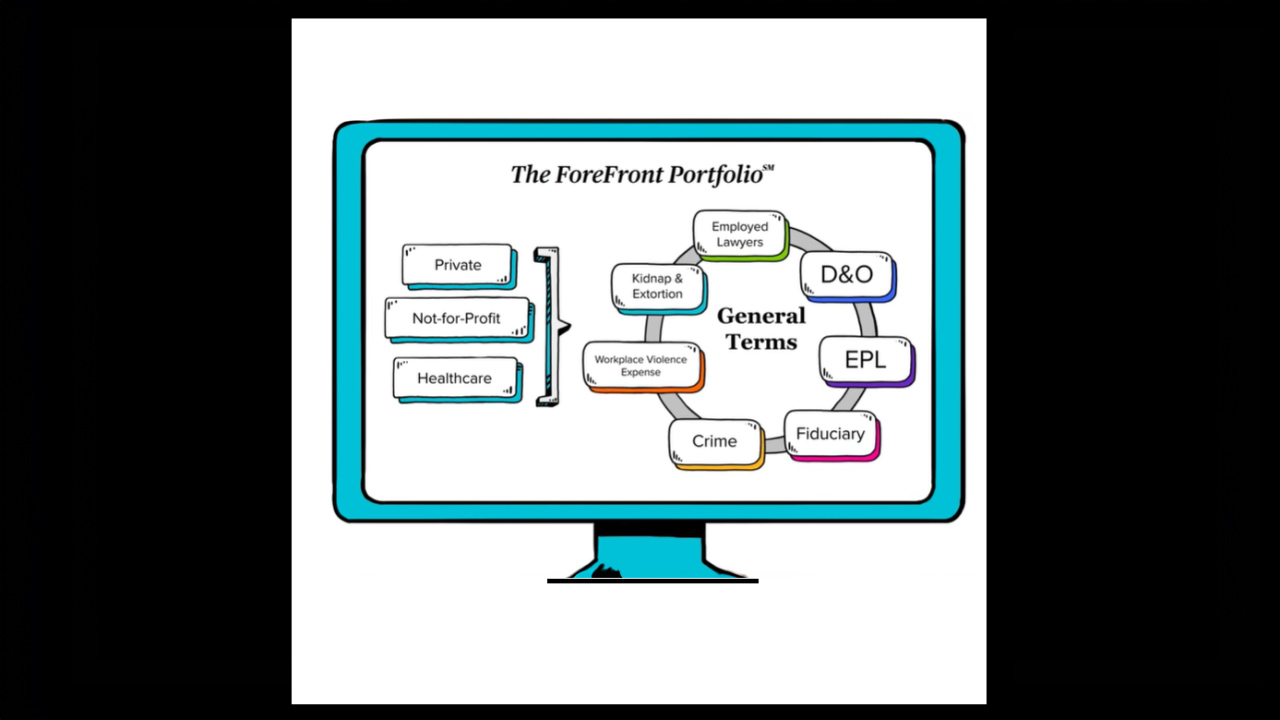

The ForeFront Portfolio

With up to seven optional coverage parts, each coverage part works as a standalone policy or seamlessly together to minimize gaps and reduce overlaps in a risk management program, providing companies choice and flexibility to help manage their individual and corporate exposures.

Employment Practices Liability (EPL)

Uncover the risks that are not covered by traditional general liability or business owner policies, and learn why having EPL insurance is crucial for safeguarding an organization against costly employment-related claims.

Watch this series of short videos to learn how to help shield your business from financial risk

Click through this carousel to watch short, educational videos, including an overview of The ForeFront Portfolio product package, as well as specific coverages, like Employment Practices Liability, Fiduciary Liability, and Crime Insurance.

Crime Insurance

The ForeFront Portfolio is one way to help protect an organization from the rising threats of social engineering fraud and theft or embezzlement by trusted employees.

Fiduciary Liability

In this informative video, we unpack the complexities of fiduciary duty and the potential risks faced by fiduciaries and plan managers in this dynamic landscape. Gain valuable insights on how Chubb's Fiduciary Liability coverage can help shield your organization from financial losses.

Supported by expert underwriting, exceptional claims handling, and value-added loss prevention services, The ForeFront Portfolio is designed to provide comprehensive, coordinated, and consistent insurance protection to private companies and not-for-profit organizations.

If you’re looking for all of the general offerings you’ve come to rely on, we’ve got you covered. But we also want to help you fill in the gaps and reduce overlaps in your risk management program. How? By offering a flexible insurance product where you decide what coverages meet your individual needs.

With a variety of coverage options, each coverage part works as a standalone policy or seamlessly together.

Chubb's flagship management liability product is designed to be at the forefront of your risk management program, with available coverages like:

- Directors & Officers Liability

- Employment Practices Liability

- Fiduciary Liability

- Employed Lawyers Liability

- Crime

- Kidnap, Ransom & Extortion

- Workplace Violence Expense

Comprehensive coverage with numerous options and combinations

Learn about the coverage selections.

The ForeFront Portfolio is designed to help companies not only survive, but thrive despite the most complex threats of litigation, extortion, and other white-collar crimes that may expose their bottom line.